Introduction

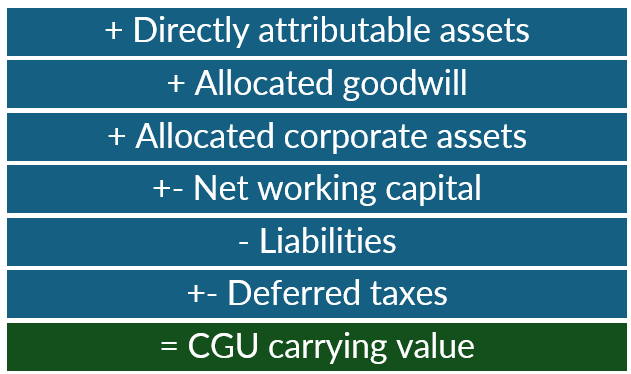

Accountants are often tasked with preparing the underlying data for carrying values of Cash Generating Units (“CGUs”) that are used in the impairment tests. The CGU “is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets”. Cash flows included in the calculation of a value in use model should be consistent with the assets that are included in carrying amount of a CGU, and vice versa. Below are summarised the main and most common input categories into CGU carrying value:

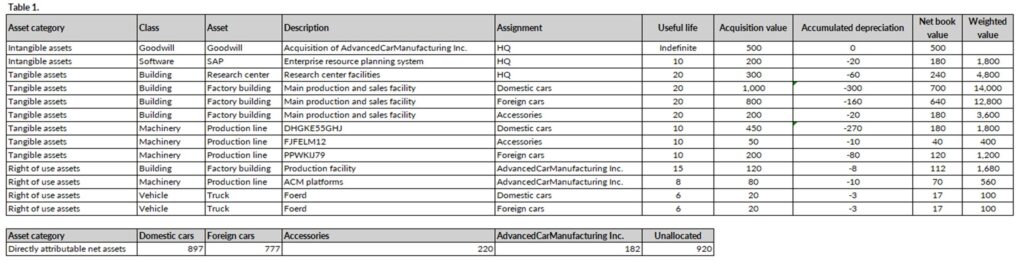

The subsequent sections will detail how this is included, and it will be illustrated with example numbers. We will assume that the company has identified 4 main CGUs: Domestic cars, Foreign cars, Accessories, and AdvancedCarManufacturing Inc.

Directly attributable assets

In the first step, it is necessary to include the directly attributable assets to CGUs. Most commonly, the basis is a fixed asset register of the entity or several entities.

Goodwill

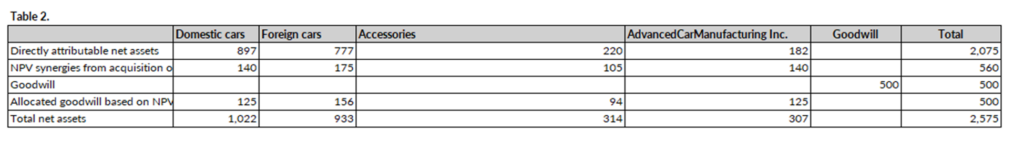

In the second step, we proceed with allocation of goodwill to CGUs that arose upon acquisition of AdvancedCarManufacturing Inc. IAS 38 requires that goodwill is allocated on the basis of expected synergies from a business combination. This may be quite complex to evaluate and certain judgements need to be made. One of the possibilities is to perform a pre-combination and post-combination analysis in order to allocate synergies. Synergies generally arise from cost savings (for example, economies of scale, reduced overhead costs), or from a revenue side (for example, due to bigger pricing power, higher market share, or cross-selling of products). It is also possible to perform allocation on the basis of relative carrying values of impacted CGUs, but this is generally less reliable. Goodwill allocated solely to the acquired business can also lead to unnecessary impairment losses, as it extraordinarily increases the carrying amount of such CGU.

For smaller companies, accountants themselves may be involved in deal making process and preparing all relevant data for the deal, including the calculation of synergies, in which case they already have the necessary input. For large corporate, however, there may be a separate M&A team from whom it may be necessary to request the calculation of synergies backup in order to allocate the resulting goodwill to individual CGUs. As an illustrative example, let’s assume it looks as follows:

Corporate assets

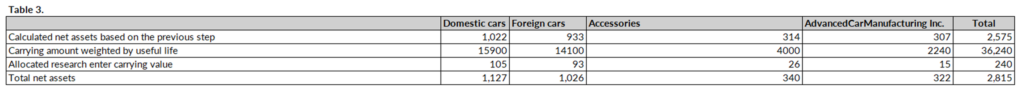

In the third step, it is necessary to attempt to allocate corporate assets to individual CGUs. The guidance on how this can be done is limited. Generally, it is however accepted that this is done on the basis of relative carrying amounts of CGU weighted by the assets’ expected useful life. However, other bases are also permitted, provided that they provide more relevant allocation. For example, certain assets may be allocated on the basis of utilization metrics, floor space, headcount, revenue, and so on. The key point is that allocation should reflect the extent to which each CGU benefits from a given corporate asset.

(A) Research center allocation

(B) Software allocation

As for software, let’s make in this case an assumption that it could not be allocated to CGUs on a any stable and non-arbitrary way that would be representative of how each CGU benefits from it and that would not change significantly each year. For example, carrying amounts are not representative of how software asset is utilised by each CGU, and neither can other parameter be reliably used in this case. Hence software asset would be tracked separately in the CGUs working file.

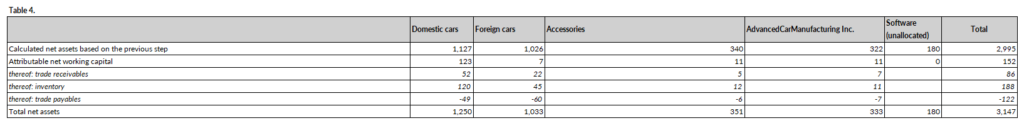

Net working capital

Next, entities have a choice whether to include or exclude working capital balances from the carrying amounts of a CGU, so long as there is a consistent application to the inclusion or exclusion of cash flows from working capital items in determining the CGU’s recoverable amount. IAS 36 scopes out a number of items that may be included within an entity’s working capital balance (such as inventories). However, for the purposes of determining the carrying amount of the CGU and related cash flows, it may be appropriate to include such items even if they are scoped out. This links to the way in which recoverable amount of a CGU is determined. Provided that the entity is consistent in including and excluding such items, outcome of impairment test will be the same. In practice, working capital is included in the valuation models and hence also in carrying amount of assets. Sometimes working capital needs to be “normalized” for the purpose of impairment test, especially if there is a significant volatility. Furthermore, as impairment test aims to obtain an “external” view of the CGU value, intercompany receivables, intercompany payables, and other relevant intercompany balances are included in working capital as well.

Other items – liabilities & deferred taxes

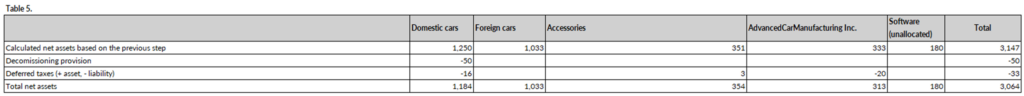

(A) Liabilities

General principle is that liabilities can be included in the carrying amount of a CGU only if a recoverbale amount of the CGU cannot be determined without such liability. For example, they would be included in case a potential buyer would need to assume them upon purchase of a CGU. These could be pension obligations, leases that are connected to right of use assets, certain payables and provisions. In this case a consistency is again needed, between carrying amount values and value in use calculation. For example, a lease liability, the accountant may:

- a) either exclude lease liability from carrying amount of the CGU and also not deduct lease liability from value in use, or;

- b) include lease liability in the carrying amount of the CGU but then also deduct lease liability from value in use

Liabilities related directly to debt financing are excluded, as also cash outflows from interest and loan repayments are excluded from the valuation model. Financing aspect is also generally considered in a discount rate of value in use model calculation.

(B) Deferred taxes

IAS 36 requires the carrying value of a CGU to be calculated in a manner consisent with how value in use is calculated. Hence by default it would be expected that tax balances are excluded from carrying amounts of a CGU. However, in practice these balances are included generally for consistency reasons due to how business combination is accounted for, especially if there are significant deferred tax balances that arise upon fair value adjustments. These deferred tax balances may significantly decrease the net value of assets acquired, and consequently increase goodwill recognised upon acquisition. Excluding them from carrying amount could lead to an immediate impairment. In the example below we will assume a decomissioning provision of -50 that would need to be assumed by a buyer of a CGU. Also, the deferred taxes relevant for each CGU have been included.

The company would need to ensure it treats it consistently also within its value in use model calculation.

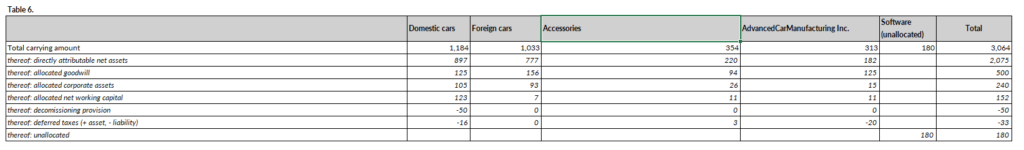

Summarised carrying values

Below is a summary of the values we compiled and derived that can be used for impairment test. In this case the next step is quite conditional on the organization. In the smaller companies, accountants themselves may be in charge of preparing the value in use model calculations, while in the large corporates there may be a separate team responsible, such as controlling or valuation that does the assessment.

Excel file attachment

The attached file contains the tables and the relevant formulas.

Conclusion

The following post illustrated how CGU carrying values can be collected, calculated, and used for impairment tests.