Introduction

The following post deals with more specific issues that arise in practice under IAS 23. Some of the common issues with respect to application of IAS 23 are as set out below.

1. Can cost of equity and cost on equity instruments in general be capitalised under IAS 23?

No, the standard foresees only liabilities as allowable for borrowing costs capitalisation. Certain instruments, such as preferred shares, may be classified as liability and not equity, and in such case their related dividends and other expenses can be capitalised under IAS 23.

2. Can provisions and their interest expense be capitalised as borrowing costs?

No, per standard borrowing costs are expenses that are incurred in connection with financing arrangement. Interest expense, for example, unwinding of discount on provisions does not meet this definition and hence should be excluded for this purpose.

3. Can investment income earned on general borrowings be deducted from borrowing costs available for capitalisation?

No, only investment income earned on borrowings that are specifically dedicated to financing of a given investment can be deducted from capitalised borrowing costs. As regards general borrowings, it cannot be demonstrated that investment income is earned from them, and not, say, from equity or cash generated from operating activities.

4. Should hedging be considered for the purpose of determining borrowing costs for specific or general borrowings?

It should be considered for both, as hedging modifies overall borrowing costs. Actual payments and accruals should be included in the calculation. However, changes in fair value of hedging instruments are typically excluded, as they are not borrowing costs, but rather simply changes in present value of future expected cash flows of hedging instrument, and hence are not covered by IAS 23 borrowing costs definition.

5. Can entity argue that investment is financing from its balance sheet cash or operating cash flow, and not borrowings, and consequently not capitalise any borrowing costs?

No, this cannot be done, as it is presumed that general borrowings are used in the first instance to finance investments. Consequently, if IAS 23 criteria for capitalisation are met, these borrowings costs must be capitalised.

6. The entity obtained an interest-free loan and used it for investment which qualifies under IAS 23. How should it be treated?

The loan should be recognised at its fair value, with the difference between cash proceeds received, and fair value posted into income statement or equity, depending on the nature of the transaction. The interest-free loan should then be measured at amortised cost – unless it has some other exotic features – with interest accrued using effective interest rate method. The interest determined using the effective interest rate method is an element of borrowing cost and would be capitalised under IAS 23.

7. Once investment is completed, should unpaid specific loan be transferred to the pool of general borrowings when determining general capitalisation rate?

Yes, unpaid specific borrowings should be included within the pool of general borrowings as long as it is outstanding, and considered in calculation of general capitalisation rate.

8. Foreign exchange differences with illustrative example

IAS 23 requires that foreign exchange differences are also considered for determining borrowing costs that are capitalised, but only to the extent to which they can be regarded as an adjustment to interest costs. This is quite tricky, because it is unclear in practice which part of foreign exchange differences relates to adjustment to interest cost, and which results from other factors, such as macroeconomic conditions and regulation. There are two possible approaches for accountants as to how to determine this portion in practice:

- (A) Estimate foreign exchange movement based on forward currency rates at the inception of the loan, or

- (B) Estimate the foreign exchange movement based on a difference between the interest expense incurred due to the actual loan taken in a foreign currency vs. the “would-be” interest expense had the entity taken a loan in its functional currency

Entity can choose either of the aforementioned approaches, but must then apply it consistently as it is an accounting policy choice. In practice, the latter (B) approach is more prevalent. This is illustrated below.

Illustrative example

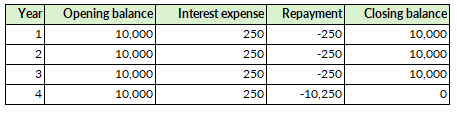

Assume that the entity’s functional currency is USD, and it took a loan denominated in EUR to take advantage of lower interest rates in Eurozone. Assume that it is a 4-year loan, with EUR 10,000 principal and 2.5% interest payable at each year end, with principal being payable at the end of loan term in a single bullet repayment. Equivalent USD loan carries 5% interest. The payment schedule looks as follows:

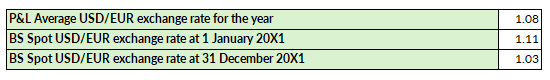

Secondly, assume that these are the foreign exchange rates as applicable to USD/EUR:

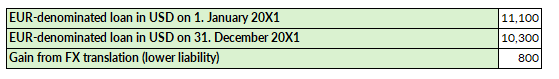

Consequently, the loan balance looks as follows:

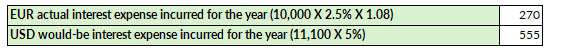

Comparison of interest expenses, EUR-denominated loan vs. ‘would-be’ USD-denominated loan:

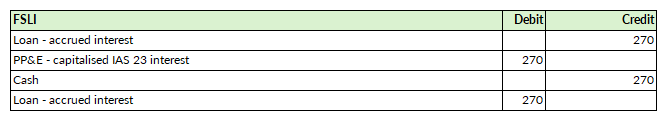

Initial booking of the resulting interest expense is as follows:

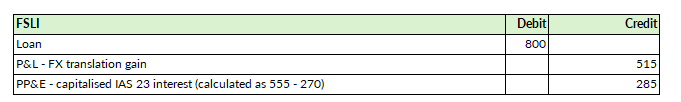

Booking of FX impact related to capitalised borrowing costs is as follows:

The total capitalised borrowing cost under IAS 23 for the period would then hence equal to USD 555 (270 + 285).

Conclusion

This post described some of the common IAS 23 application issues in practice and the respective solutions.