Introduction

When an asset that is constructed over a longer period of time is financed from borrowings, the related financing costs are capitalized into the cost of such asset. This article explains the core principles of IAS 23 Borrowing Costs and provides an illustrative example which shows how to apply these principles.

IAS 23 Key Principles

Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset form part of the asset’s cost, subject to certain criteria. All other borrowing costs are recognized as an expense in the period incurred. Borrowing costs include interest and related costs incurred in connection with borrowing funds. A qualifying asset is one that necessarily takes a substantial period to get ready for its intended use or sale, such as property, plant, and equipment; intangible assets; or long-cycle inventory like ships or aircraft.

If the entity borrows specifically for a qualifying asset, eligible borrowing costs are the actual costs of that borrowing, reduced by any investment income earned on temporarily invested borrowed funds. If the entity uses general borrowings, it applies a capitalization rate – based on the weighted average of all borrowing costs outstanding during the period – to expenditures on the qualifying asset, excluding specific borrowings for assets nearing completion. The total amount capitalized cannot exceed the total borrowing costs incurred in that period.

Commencement of Capitalization

Capitalization begins when expenditures for the asset are incurred, borrowing costs are being incurred, and activities necessary to prepare the asset for its intended use or sale are in progress.

Suspension of Capitalization

Capitalization is suspended during extended periods in which active development of the asset is interrupted.

Cessation of Capitalization

Capitalization ends when substantially all activities needed to prepare the asset for use or sale are complete. If an asset is built in parts that can be used independently, capitalization ends for each part as soon as that part is ready for its intended use or sale.

Illustrative example

Summary

The company has borrowed general funds CU 1,500 million at 4% effective interest rate, and a loan of CU 300 million at 2.5% effective interest rate borrowed specifically to finance this development of office area with 3 office buildings (Office building 1, Office building 2, Office building 3) on 1 January 20X1. The latter borrowing is taken out specifically for construction of the Office building 3. The construction commenced on 1 April 20X1. On 30 May 20X1, Office building 1 was completed. On 30 September 20X1, due to lack of contracted workers the work on office building 2 was suspended, and continued on 1 November 20X1. On 1 August, the company obtained a further general borrowing of CU 500 million at 22% effective interest rate. For the period 1 November 20X1 – 31 December 20X1, interest income of CU 1 million was earned on borrowings as they were deposited in the short term deposit account. For the sake of simplicity, all of the aforementioned borrowings have a simple conditions with interest being paid annually.

Investment expenditures – chronologically

- 1 April 20X1, CU 300 million, related to Office building 1

- 1 May 20X1, CU 200 million, related to Office building 1

- 30 June 20X1, CU 600 million, related to Office building 2

- 30 September 20X1, CU 700 million, related to Office building 3

- 1 November 20X1, CU 100 million related to Office building 2

Loans and loan repayments – chronologically

- 1 January 20X1, general borrowing of CU 1,500 million at 4% effective interest rate

- 1 January 20X1, special purpose borrowing of CU 300 million at 2.5% effective interest rate

- 31 July 20X1, a repayment of CU 200 million of 4% effective interest rate general borrowing was made

- 1 August 20X1, general borrowing of CU 500 million at 22% effective interest rate

Relevant events for capitalisation – chronologically

- 1 April 20X1, CU 300 million, related to Office building 1

- 1 May 20X1, CU 200 million, related to Office building 1

- 30 June 20X1, CU 600 million, related to Office building 2

- 31 July 20X1, a repayment of CU 200 million of 4% effective interest rate loan was made

- 1 August 20X1, general investment purpose borrowing of CU 500 million at 22% effective interest rate, partly to replace the previous repayment of CU 200 million

- 30 September 20X1, suspension of work on Office building 2

- 30 September 20X1, CU 700 million, related to Office building 3

- 1 November 20X1, CU 100 million related to Office building 2 and work resumed

- For the period 1 November 20X1 – 31 December 20X1, interest income of CU 1 million was earned on borrowings as they were deposited in the savings account

Calculation of interest expense that can be capitalised – chronologically

- April 20X1 – 1 May 20X1, CU 1.00 = 300 X 4% X 1/12. CU 1.00 million capitalised interest expense, calculated as CU 300 million cumulative investment expenditure X 4% effective interest rate X 1/12 period

- 1 May 20X1 – 30 June 20X1, CU 1.67 = 500 X 4% X 1/12. CU 1.67 million capitalised interest expense, calculated as CU 500 million cumulative investment expenditure X 4% effective interest rate X 1/12 period, given that Office building 1 was completed on 30 May 20X1.

- 30 June 20X1 – 31 July 20X1, CU 2.00 = 600 X 4% X 1/12. CU 2.00 million capitalised interest expense, calculated as CU 600 million cumulative investment expenditure X 4% effective interest rate X 1/12 period.

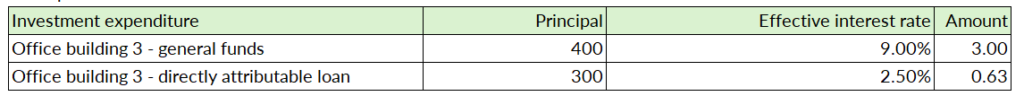

- 31 July 20X1 – 30 September 20X1, CU 9.00 = 600 X 9% X 2/12. CU 9.00 million capitalised interest expense, weighted average interest rate of 9% calculated as below:

- 30 September 20X1 – 1 November 20X1, CU 3.63, suspending capitalisation on the Office building 2 at this point, so only the amount of interest expense related to CU 700 million invested into the ongoing construction of Office building 3 was capitalised. The proportion invested amount was split between the special purpose CU 300 million loan part, and the CU 400 million part which was financed from the general borrowings, calculated as below:

- 1 November 20X1 – 31 December 20X1, CU 16.75, given that work on Office building 2 was resumed and further CU 100 million has been capitalised into fixed assets, and CU 1 million interest income was earned on borrowings which is deducted from the overall expense. Capitalised interest expense was calculated for 2 months period, and it was calculated as below:

Conclusion

The article explained the key principles of IAS 23 and provided the illustrative example that shows how to apply these principles.