Introduction

Business combinations under common control (“BCUCC”) occur due to various strategic reasons, including organizational restructuring, IPO preparation, tax optimization, or preparation for future divestitures. These transactions typically materialize in merging of subsidiaries under a single parent, intra-group business acquisitions, or introducing a new parent entity atop a group. Such transactions are not governed by IFRS 3 as they don’t alter the ultimate control of the business; control merely shifts ‘within’ the group.

How do I know I deal with a business combination under ‘common control’?

BCUCC refers to mergers where all entities involved are controlled by the same party or parties before and after the transaction, with this control not being temporary. IFRS includes a provision against transient control to prevent circumventing acquisition accounting by briefly establishing common control. For instance, if entities are controlled by the same special purpose vehicle just around the transaction time, this would be considered transitory and thus fall under IFRS 3.

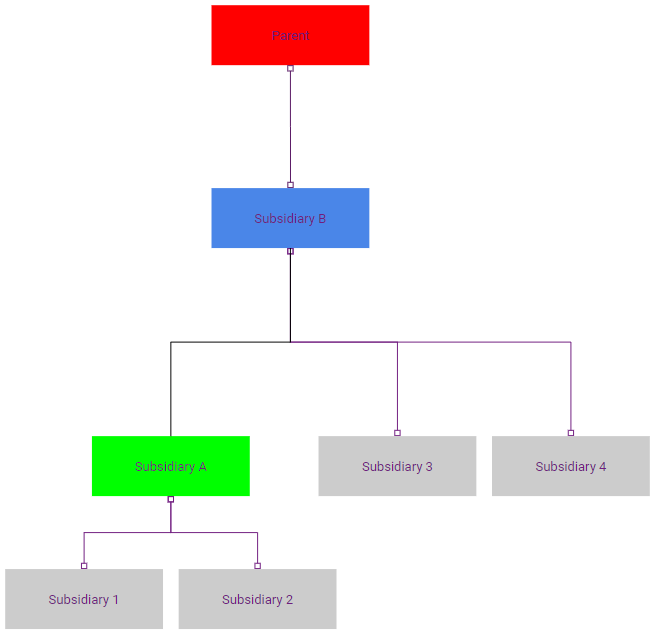

Pre-acquisition – Subsidiary B acquires Subsidiary A:

Post-acquisition – both entities are still owned by the same ‘Parent’ entity, so there is no change in the ultimate control:

Current challenges

Despite IFRS 3 detailing the acquisition method for business combinations, it doesn’t address BCUCC. This gap has led to inconsistent reporting practices adopted by accountants. As regards BCUCC, some entities apply the acquisition method, recognizing assets, liabilities, and goodwill at fair value. This practice is generally preferred when there is a significant non-controlling interest impacted by the BCUCC transaction. The approach follows IFRS 3 in this case which is well described.

For other cases, it is sufficient and generally more reasonable to use so-called book-value method. In this case, the accounting is done on the basis of original book values of assets and liabilities without any further fair value adjustments. Given that there is no accounting standard for this approach, the focus below will be on this approach.

Book-value method – accounting

As BCUCC falls outside the scope of IFRS 3, entities must rely on judgment to develop accounting policies under IAS 8, ensuring relevance and reliability. However, there has been an ongoing discussion within the IFRS community and particularly dealt with by the International Accounting Standards Board, and generally, the following practice seems to be the most acceptable going forward.

- Assets and Liabilities: Recorded at their existing carrying values without fair value adjustments, typically reflecting the book values from the transferred entity (if unavailable, using other closest sources of information, such as consolidated financial statements.)

- Intangible Assets and Contingent Liabilities: Recognized only if previously recognised by the acquiree under applicable IFRS (must follow requirements of IAS 37 or IAS 38) – no separate recognition as is the case under IFRS 3

- Goodwill: No recognition of new goodwill. Any difference between the acquirer’s investment cost and the acquiree’s equity appears as a separate reserve within equity upon consolidation.

- Transaction Costs: Expenses like legal and administrative fees are immediately written off in the profit or loss statement.

- Inclusion in Financial Statements: Generally, entities consolidate the acquiree’s results only from the combination date, prospectively. Some practice in the past included including the acquiree’s financials from the start of the comparative period, restating pre-combination financials. The main argument in favour of this approach was that adjusting it for the intra-entity transactions and balances will represent more fairly the position and performance going forward. However, the current accounting trends favour the prospective approach.

- Consideration Measurement: In practice, the consideration is valued using a book-value approach. There is no uniform approach, but the current practice seems to favor that consideration paid in assets should reflect their book values, while liabilities should be measured at amounts determined by relevant IFRS Standards applied by the controlling party (e.g., IFRS 9).

- Disclosure Requirements: Entities should consistently apply their chosen policy to similar transactions and disclose material aspects, including (1) the description of the accounting method adopted, (2) details about the involved entities, (3) transaction specifics, such as the transaction date, consideration paid, and the purpose of the BCUCC, and (4) difference between paid consideration and received assets and liabilities which was recognised in equity.

Conclusion

The approach mentioned above captures the most recent developments and trends within the IFRS community and standard setting bodies. In general, the International Accounting Standards Board is aware of the differences in practice and they want to improve comparability and transparency. Consequently, they are in the process of issuing a more unified guidance with clearer guidelines for method application in different scenarios.